Successful trading isn't rocket science, but there is some science to it.

Trade smarter with order flow...The Orderflows Flowsbounce

For NT8

For NT8

The market may be unpredictable, but it's not out of reach. You can use order flow see changes in the trend and take advantage by trading when they occur!

Introducing The Orderflows Flowsbounce

Hi, this is Michael Valtos and I have been trading since the 1990's at some of the biggest banks and trading firms - JP Morgan, Commerzbank, Cargill and EDF Man. One of the most important things I learned is that markets move based on how traders are trading it. What that means is markets move because of the actual buying and selling taking place in the market by the market participants. A trader can see what other traders are doing by reading the order flow.

What separates the Orderflows Flowsbounce from standard price based indicators like stochastics, MACD, moving averages, etc. is they are derived from the same data - price. In a basic sense they are just a number series.

Order flow traders are not priced based traders and that opens up a whole new view of the market. Not only can order flow traders see what price is doing, but also how traders are reacting to new prices. Once a trader realizes what is really taking place in the market, they find their trading transformed and actually become a trader instead of a trade follower.

Order flow traders are not priced based traders and that opens up a whole new view of the market. Not only can order flow traders see what price is doing, but also how traders are reacting to new prices. Once a trader realizes what is really taking place in the market, they find their trading transformed and actually become a trader instead of a trade follower.

Successful trading isn't rocket science, but there is some science to it.

Let me ask you if you remember your high school physics class, but more precisely, Sir Isaac Newton's three laws of motion.

Isaac Newton's three laws of motion are used by many traders, and often times without many traders even realizing it.

Law Number 1 : A market that is not moving stays at rest and the markets that are moving up or down in price follow whichever trend they're currently on.

The market is constantly changing and so are the forces that affect it. An external force can change this situation in a number of ways, such as an economic event or news story which creates fear among traders. Mental factors like psychology may also have big impacts on how traders react during times where uncertainty reigns supreme.

As a trader, you have to use your skills and experience in order not make wrong decisions. If the market trend isn't taken into consideration when making trading decisions, then you risk losing money because it could lead towards bad decision-making which will eventually result from taking these kinds of trades.

To be a successful trader, you need to learn how the market changes its trend. When looking at factors that can cause change in market direction accurately and anticipating those trend changes in time will give traders an edge over their competitors because they're predicting what everyone else wants to do before hand!

The market may be unpredictable, but it's not out of reach. You can use certain factors that predict changes in the trend and take advantage by trading when they occur! The order flow reveals so much information to the trader, if the trader would simply process that data correctly.

The Orderflows Flowsbounce does that.

Law Number 2 - The market is constantly in motion, the direction changing depending on what traders are doing. The aggressive traders have a direct effect and change it too; opposite for those who have lots supply or want to accumulate supply - they make the market stable with their volume.

Markets are driven by the opinions of buyers and sellers which means that any changes in sentiment can cause an unexpected movement for stocks prices up or down!

Law Number 3 - A market exists to facilitate trade between buyers and sellers. If a particular market has more demand than supply, then prices will go up. If there is more supply than demand, then prices will go down. Price will adjust accordingly because the market is searching for its equilibrium level for two-sided trade to occur to facilitate trade in volume.

The market is constantly changing and so are the forces that affect it. An external force can change this situation in a number of ways, such as an economic event or news story which creates fear among traders. Mental factors like psychology may also have big impacts on how traders react during times where uncertainty reigns supreme.

As a trader, you have to use your skills and experience in order not make wrong decisions. If the market trend isn't taken into consideration when making trading decisions, then you risk losing money because it could lead towards bad decision-making which will eventually result from taking these kinds of trades.

To be a successful trader, you need to learn how the market changes its trend. When looking at factors that can cause change in market direction accurately and anticipating those trend changes in time will give traders an edge over their competitors because they're predicting what everyone else wants to do before hand!

The market may be unpredictable, but it's not out of reach. You can use certain factors that predict changes in the trend and take advantage by trading when they occur! The order flow reveals so much information to the trader, if the trader would simply process that data correctly.

The Orderflows Flowsbounce does that.

Law Number 2 - The market is constantly in motion, the direction changing depending on what traders are doing. The aggressive traders have a direct effect and change it too; opposite for those who have lots supply or want to accumulate supply - they make the market stable with their volume.

Markets are driven by the opinions of buyers and sellers which means that any changes in sentiment can cause an unexpected movement for stocks prices up or down!

Law Number 3 - A market exists to facilitate trade between buyers and sellers. If a particular market has more demand than supply, then prices will go up. If there is more supply than demand, then prices will go down. Price will adjust accordingly because the market is searching for its equilibrium level for two-sided trade to occur to facilitate trade in volume.

About The Orderflows Flowsbounce

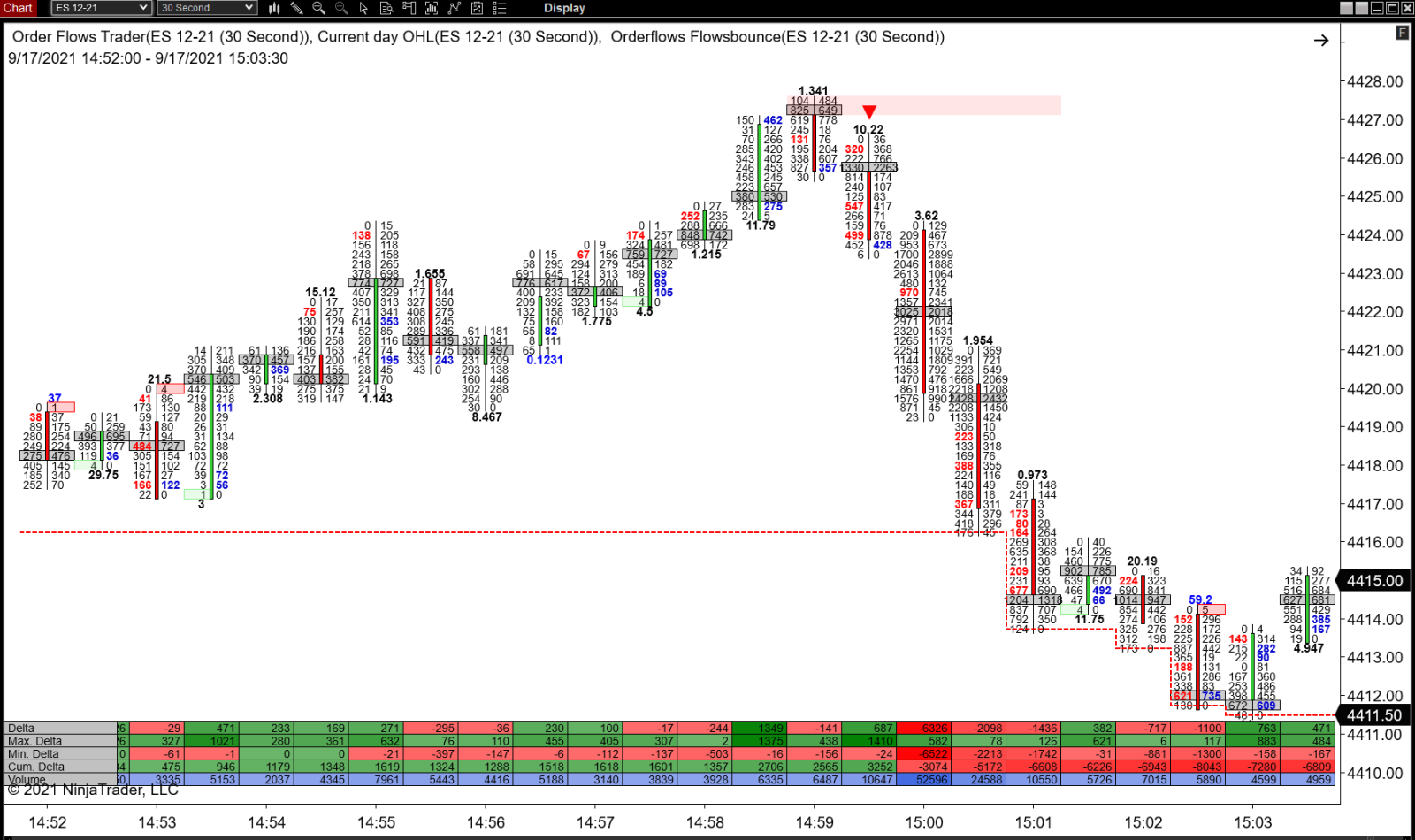

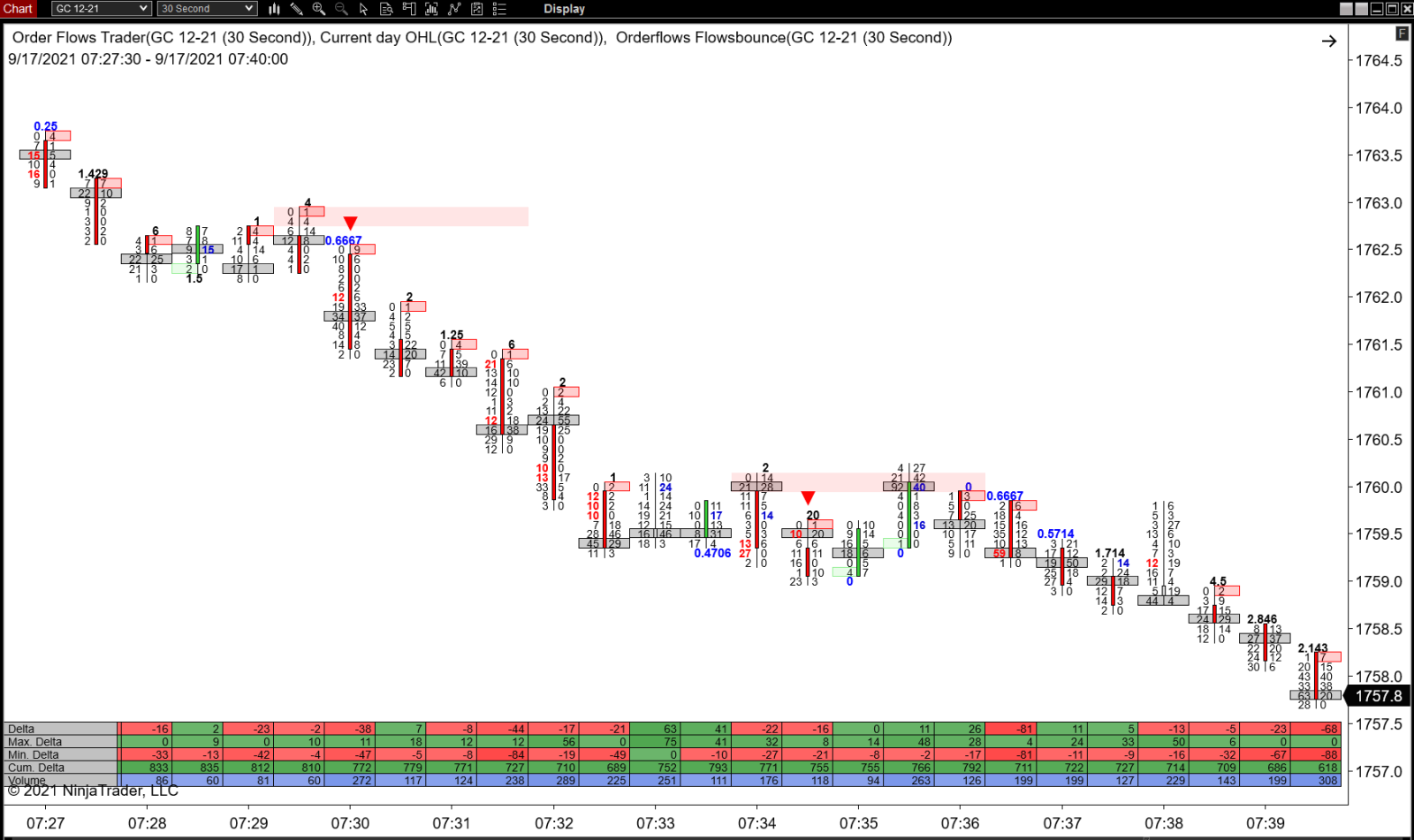

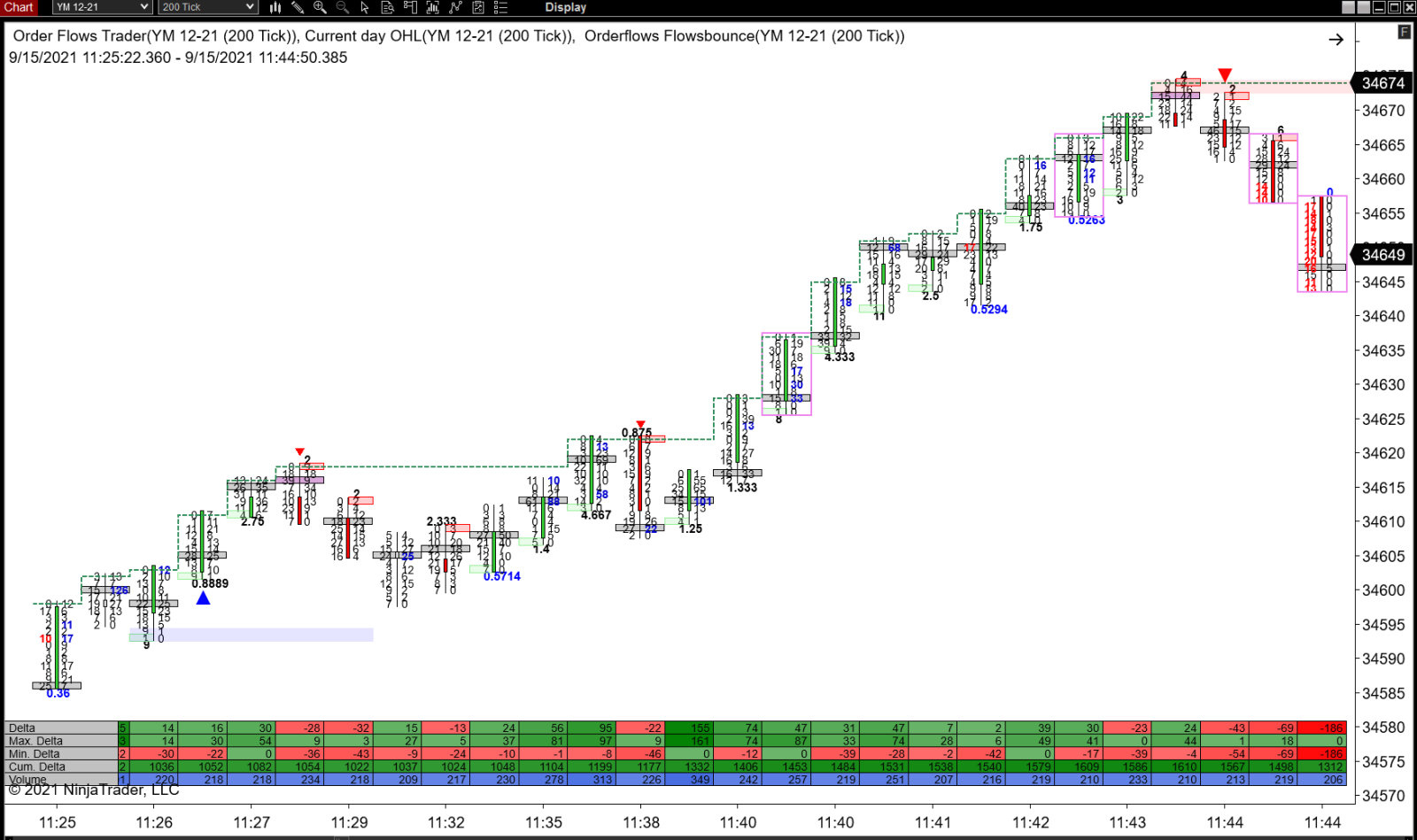

The Orderflows Flowsbounce is extraordinarily robust. That means it's order flow analysis works in different markets and chart types. If you have a trading system or method that only works in one market, in one time frame, then the reality is you don't have a valid trading system or method.

Now I'm not saying you have to go out and start trading different markets or time frames. What I am saying is you can expand your trading by analyzing and trading additional markets.

Instead of trying to force trades in a quiet market or sideways market, you can be active in active markets.

The market is always changing and it's your job as a trader to be able to see that shift in order for you take advantage. If there are certain things out of our control, like what people will buy or sell at any time during the day then those factors can change everything!

The advantage we have as screen based traders rivals what locals had back in the day of pit trading. We can pick our spots and let the market set up to its ideal best conditions and then trade it. But you have to know exactly what conditions you are looking for.

That is where the Orderflows Flowsbounce comes in.

Now I'm not saying you have to go out and start trading different markets or time frames. What I am saying is you can expand your trading by analyzing and trading additional markets.

Instead of trying to force trades in a quiet market or sideways market, you can be active in active markets.

The market is always changing and it's your job as a trader to be able to see that shift in order for you take advantage. If there are certain things out of our control, like what people will buy or sell at any time during the day then those factors can change everything!

The advantage we have as screen based traders rivals what locals had back in the day of pit trading. We can pick our spots and let the market set up to its ideal best conditions and then trade it. But you have to know exactly what conditions you are looking for.

That is where the Orderflows Flowsbounce comes in.

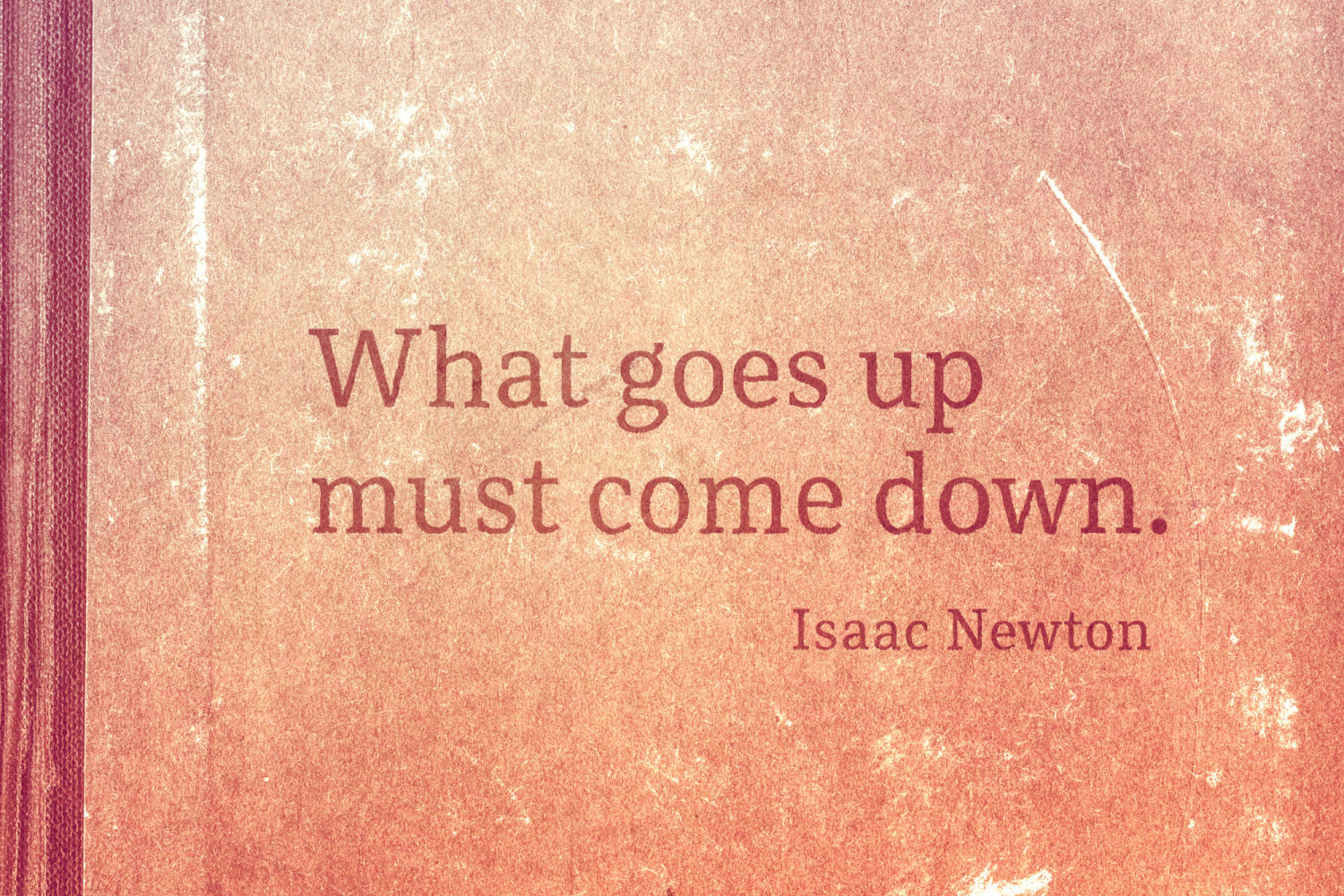

Flowsbounce In Action

Flowsbounce will also work on a normal candlestick chart.

Get Flowsbounce now for $349 sale price

Clicking on the order link will redirect you to our secure payment processor page on PayPal.

Please allow 3 to 6 hours for us to process your order. We will email you all the necessary files as soon as your order is processed.

FAQs

Q. Is the Flowsbounce a footprint chart?

A. No. The Flowsbounce is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowsbounce?

A. No, the Flowsbounce will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowsbounce work on?

A. The Flowsbounce is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowsbounce will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowsbounce available for Sierra Chart?

A. No. At the moment the Flowsbounce is only available for NT8.

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowsbounce works under different conditions.

Q. Does the Flowsbounce work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowsbounce to analyze FX markets?

A. Yes, However Forex data is not centralized so analyzing order flow from various sources is not an ideal situation. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowsbounce?

A. Futures work best with the Flowsbounce.

Q. What time frame is best for Flowsbounce?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowsbounce performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

Q. Is there a sound alert?

A. Yes, there is a default sound alert that you can change to your own custom .wav file.

A. No. The Flowsbounce is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowsbounce?

A. No, the Flowsbounce will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowsbounce work on?

A. The Flowsbounce is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowsbounce will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowsbounce available for Sierra Chart?

A. No. At the moment the Flowsbounce is only available for NT8.

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowsbounce works under different conditions.

Q. Does the Flowsbounce work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowsbounce to analyze FX markets?

A. Yes, However Forex data is not centralized so analyzing order flow from various sources is not an ideal situation. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowsbounce?

A. Futures work best with the Flowsbounce.

Q. What time frame is best for Flowsbounce?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowsbounce performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

Q. Is there a sound alert?

A. Yes, there is a default sound alert that you can change to your own custom .wav file.

Why You Need The Orderflows Flowsbounce...

The Orderflows Flowsbounce is the one of the fastest and easiest ways to add order flow analysis to your trading even if you don't want to learn order flow.

Flowsbounce works with your favorite indicator.

The Orderflows Flowsbounce allows you to easily add another trading tool to your tool box to help you find great trading opportunities.

Flowsbounce analyzes the order flow for you.

The Orderflows Flowsbounce helps you understand what is happening in the market based on what is trading right now.

Get started now...

Copyright 2021 - Flowsbounce.com & Orderflows.com- All rights reserved

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..